How to get my w2 from amazon former employee.

Learn how to get a wage and income transcript or a copy of Form W-2 from the IRS, depending on whether you e-filed, attached it to your paper return, or …

They can often secure a duplicate W-2 so that you can file your taxes. An employee at Academy Sports and Outdoors can get a copy of their W-2 income tax form from the online paystub website at ...Confused about paying employee mileage reimbursement and whether it’s taxed? Read our ultimate guide to learn everything you need to know. Human Resources | Ultimate Guide WRITTEN ...Yes, of course you can get a copy of your W2's all you need to do is go into Integrity Staffing Solutions and ask for your W2's. They will help you, which you need to type your name and social security number on a computer and print your W2's which you'll receive and you'll be on your way. Have a good day.This includes your Social Security number, your date of birth, and your mailing address. Once you have this information, you can request your W2 in one of three ways: 1. Call the Wendy’s corporate office at 1-614-764-3100 and ask for the HR department. They will be able to help you request your W2.

Updating Tax Information. Log in to Amazon Associates Central. Click on your email in the upper right hand corner. Click “Account Settings”. Scroll down to View/Provide Tax Information. Your Current Tax Status will be displayed. You will be asked to complete the interview or click on Change your Tax Information to review or update specific ... A subreddit for current, former and potential Amazon employees to discuss and connect. If you have any questions, comments or feedback regarding the subreddit, please feel free to send us a message through modmail. Please note: We are not a customer support subreddit, please reach out to appropriate contact points for assistance with your order.

Learn how to get your W-2 from Amazon after leaving the company. Find answers from experts and former employees on Intuit.

Learn how to get your W-2 from Amazon after leaving the company. Find answers from experts and former employees on Intuit.A subreddit for current, former and potential Amazon employees to discuss and connect. If you have any questions, comments or feedback regarding the subreddit, please feel free to send us a message through modmail. Please note: We are not a customer support subreddit, please reach out to appropriate contact points for assistance with your order.If directly reaching out doesn’t help, it’s time to contact the IRS. If your former employer does not act on your request for following up on your W-2 or you are unable to reach them, then it is time to reach out to the IRS. Provide the IRS with: Your name, address, Social Security number and phone number. Employer’s name, address …Former and current Cracker Barrel employees can use the same website to access electronic copies of their W-2 forms. Alternatively, employees may also call 1-800-240-4367 and ask for Ext. 63013 to request a W-2 form, as of December 2015. Hourly employees of Cracker Barrel are eligible for up to three pay raises in their first year.Go to the ADP website My.ADP.com and select Create an Account with an employer code. The code will be whf2-w2. Then, go through the process of creating an account, which will ask for your old employee ID number and an employer number/code or whatever. The code/number to input for that will be r9n. Then, once you've made an account, go to the ...

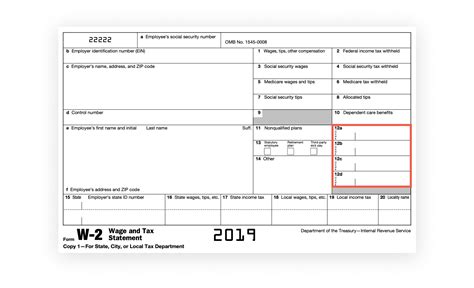

Whether you work at Amazon or any other place, you are supposed to receive Form W-2 reporting the wages you received and the taxes you’ve paid through withholdings. At least, federal law requires employers to send these to their employees. You should’ve been able to receive your Form W-2 in the mail, by hand, or electronically.

For Charter communications/Spectrum current and former employees can access W-2s online with ADP. Call 833-474-2487 select appropriate number for the language you prefer 🤦🏻♀️ and then select 5 for other questions for the team. They can give you a sign on for ADP that will still work even if you are a former employee.

Employees get a copy of Form W-2 from their employers. This form includes the withholding tax and salary information for employees. Employers must send a copy of W-2 to the IRS and their employees every year. It is issued to employees of an entity. W-2 is not issued to self-employed or independent contractors.Access your employee documents, such as pay stubs, tax forms, and benefits information, with your Amazon login credentials. Note: Since your browser does not support JavaScript, you must press the Resume button once to proceed. Is there a number, corporate department, person, or portal I can access them through? I still know my employee ID and the store number of where I worked, if that will help me. Archived post. New comments cannot be posted and votes cannot be cast. 717-761-2633, hit zero and ask for payroll. Did you get the help you needed?Hence, having a proper understanding and managing your W-2 forms correctly is vital for your financial well-being. Steps to Get W2 from a Former Employer. Obtaining a W-2 may seem simple, but it requires attention to detail. Here are the steps: Check the Date. Timing is an essential factor when it comes to obtaining your W-2 form.

Paystubs are digital or paper-form documents that employees get with their monthly pay slips. Form W2 is the Wages, and Tax Statement employees get from their employer in every tax year. The employer has to send the Form W2 to the employee by the 31 st of January of a tax year. Shoprite employees can get their paystubs and Form W2 by ...Tax Forms Now Available. The 2022 W-2 and 1095-C forms were either mailed or made available on Jan. 31. If you have any questions about your tax forms, please call the EmployeeCentral Contact Center at 855.475.4747, option 1. If you opted to receive your tax forms online, here's how you can access them: W-2 Form for CHI-Affiliated …U.S. publishers. We issue Form 1099-MISC on or before January 31 each year (or the following business day if January 31 falls on a weekend or legal holiday). Non-U.S. publishers. We issue Form 1042-S on or before March 15 each year (or the following business day if March 15 falls on a weekend or legal holiday).An IRA (individual retirement account) is a tax-advantaged account meant to help you save enough over the long term to be comfortable when you retire. They’re designed with savings...Once you have your registration code, you can register at login.adp.com. Employee Registration. Select Register Now to start the registration process. Follow the steps to enter your registration code, verify your identity, get your User ID and password, select your security questions, enter your contact information, and enter your activation code.Stanford must report all employee taxable wages and the associated taxes paid to federal and state agencies. At the beginning of each tax year (Jan. 1 to Dec. 31), Stanford sends a completed W-2 Wage and Tax Statement Form (W-2 Form) to each employee, which they can use when filing their federal and state income tax returns (refer to Resource: W-2 Form Fields and Descriptions).

They should have mailed it to you. If not, call their HR. Mine was mailed to me. Check for emails from the time you were hired/trained/on boarded. If you’ve deleted them all. Try calling your store. They will be annoyed with you but should be able to help.A subreddit for current, former and potential Amazon employees to discuss and connect. If you have any questions, comments or feedback regarding the subreddit, please feel free to send us a message through modmail. Please note: We are not a customer support subreddit, please reach out to appropriate contact points for assistance with your order.

As an employee, it is important to have a clear understanding of your income and the taxes that are deducted from your paycheck. However, calculating payroll withholding can be com...For Charter communications/Spectrum current and former employees can access W-2s online with ADP. Call 833-474-2487 select appropriate number for the language you prefer 🤦🏻♀️ and then select 5 for other questions for the team. They can give you a sign on for ADP that will still work even if you are a former employee. I’m an ex-employee. I have my new job W2 & can see my past W2’s from Amazon & paystubs but my 2020 W2 from amz. I called the ERC & they were essentially no help. They stated they sent an email about how to get my W2 in adp but it never arrived, before anyone asks .. yes, they have the correct email & I checked all folders too. Q&A. Stellarspace1234. •. “If you're unable to get your Form W-2 from your employer, contact the Internal Revenue Service at 800-TAX-1040. The IRS will contact your employer or payer and request the missing form.”. Reply reply.A subreddit for current, former and potential Amazon employees to discuss and connect. If you have any questions, comments or feedback regarding the subreddit, please feel free to send us a message through modmail. Please note: We are not a customer support subreddit, please reach out to appropriate contact points for assistance with your order.Yes, of course you can get a copy of your W2's all you need to do is go into Integrity Staffing Solutions and ask for your W2's. They will help you, which you need to type your name and social security number on a computer and print your W2's which you'll receive and you'll be on your way. Have a good day. First, you can easily access your W2 form online through the Pizza Hut employee website. Simply log in to your account and navigate to the section for tax forms. From there, you should be able to view and download your W2 form for the current tax year. If you no longer have access to your online account, or if you encounter any issues with ... Once your employee account is set up, follow these steps to access your pay stub: Log in to your Amazon employee account using your registered email address and password. Navigate to your account dashboard’s “Payroll” or “Earnings” section. Look for the option to view or download your pay stub for the desired pay period.Here are some more options: Order a copy from the Social Security Administration. It's free if you need it for Social Security-related reasons, otherwise, it's $126 per request. Order a full copy of your return from the IRS for $43, which will also include your W-2. Wage and income transcripts are available from the IRS free of charge.It will be mailed. I’m a current employee and got mine in the mail yesterday. If you go to postalease and click on W2 you’ll be able to select whether you want it mailed to you or not. You can screenshot from the liteblue website. They are up in postalease now, will be mailed soon I would think.

Jan 29, 2021 · If you worked for Amazon Flex during the previous tax year, you will need to obtain a W2 form to file your taxes. To get your W2 from Amazon Flex, follow these steps: Log in to your Amazon Flex account on the Amazon Flex website. Click on the “Tax Information” tab. Click on the “Download” button next to your W2 form. Save or print your ...

When will I receive a 1099 form? We will issue a 1099 form by January 29 to any Amazon Associate who received payments of $600 or more or received payments where taxes were withheld in the previous calendar year unless you are an exempt entity. Generally, payments to a corporation including a limited liability company LLC that is treated as a C ...

A subreddit for current, former and potential Amazon employees to discuss and connect. If you have any questions, comments or feedback regarding the subreddit, please feel free to send us a message through modmail. Please note: We are not a customer support subreddit, please reach out to appropriate contact points for assistance with your order. Updating Tax Information. Log in to Amazon Associates Central. Click on your email in the upper right hand corner. Click “Account Settings”. Scroll down to View/Provide Tax Information. Your Current Tax Status will be displayed. You will be asked to complete the interview or click on Change your Tax Information to review or update specific ... Historical W-2s are available up to the past 2 years. You should get your W-2 by mail in early February. If you haven't received it by then, and can't access it in QuickBooks Workforce, contact your employer. For added security, you may need to verify your phone number or some of your personal info before you can see your W-2s.To get your W2 from Amazon Flex, you need to log in to your Amazon Flex account and download it from there. Follow these steps: Log in to your Amazon Flex account. Click on the “Tax Information” tab. Click on “Download” next to your W2 form. Save the form to your computer or print it out for your records.If you have questions about your Form W-2 or Form 1099, please contact your company’s payroll or benefits department. ... If you have questions about how to view your W-2 online or are an employee of a former ADP client who is no longer in business, please see our Form W-2 and 1099 Guide for Employees. Wage Garnishment: 866-324-5191: Workers ...How do I find information about my W2? | Sprouts.com. Diet. Categories. Frequently Asked Questions. VIEW ALL. I’m a former Sprouts team member. How do I find information about my W2? Former team members may call the HR Support Desk at 844-577-7688 and select option 2. Former team members may call the HR Support Desk at …I have seen a few of these where Amazon issued two W-2's to the employee. **Disclaimer: Every effort has been made to offer the most correct information possible. The poster disclaims any legal responsibility for the accuracy of the information that is contained in this post.**Contact the human resources department: Contact the human resources department at Buffalo Wild Wings to inquire about the status of your W2. Provide your name, employee ID, and last known mailing address to ensure that they have the correct information on file. Check your mailing address: Verify that your mailing address on file with the ...Tax Forms Now Available. The 2022 W-2 and 1095-C forms were either mailed or made available on Jan. 31. If you have any questions about your tax forms, please call the EmployeeCentral Contact Center at 855.475.4747, option 1. If you opted to receive your tax forms online, here's how you can access them: W-2 Form for CHI-Affiliated …Request Through the Portal. One of the most convenient ways to obtain your W2 form from Pizza Hut is by logging into the employee portal. Once you are logged in, you should be able to access and download your W2 form directly from the portal. This process is quick and easy, and you can have your W2 in hand within minutes.

Yes, of course you can get a copy of your W2's all you need to do is go into Integrity Staffing Solutions and ask for your W2's. They will help you, which you need to type your name and social security number on a computer and print your W2's which you'll receive and you'll be on your way. Have a good day.Updating Tax Information. Log in to Amazon Associates Central. Click on your email in the upper right hand corner. Click “Account Settings”. Scroll down to View/Provide Tax Information. Your Current Tax Status will be displayed. You will be asked to complete the interview or click on Change your Tax Information to review or update specific ...Step 2 – Click ADP Security Management Services. Step 3 – Under Quick Links select Reset a User’s Password. Step 4 – Perform a search by entering one of the following: The employee User ID. Employee Last Name and Employee/Associate ID. Email address. Step 5 – Click Search. Step 6 – Click on the User Name.Instagram:https://instagram. haugan nelson watertown sdsamuel holloway car accidentjoy christiansonfatal crash jacksonville fl Retention bonus tax for employees is considered on a case-by-case basis, according to Elaine Varelas for the Boston Globe. A retention bonus is considered for tax in the year that ... car registration hamilton county tnmarriage license in brownsville texas You can call the IRS at 800-829-1040 or visit a IRS Taxpayer Assistance Center. If you’ve followed the above steps and you still don’t have a W-2 in time to file your tax return by the ... avery 18294 template for word I believe you can open a new account on ADP and access your info that. I've heard this from others but have no experience doing it. Reply. gettheyayo909. •. Yeah my former employer used ADP so when I set up my Amazon one it had my old check stubs on there. Reply More replies. true. Household employees can hurt you more than help you at tax time. You can't deduct the wages you pay from your income, although if you hire someone to care for a child younger than ...Learn how to get a wage and income transcript or a copy of Form W-2 from the IRS, depending on whether you e-filed, attached it to your paper return, or …